tax exempt resale certificate ohio

This printable was uploaded at August 22 2022 by tamble in Tax Exemption Form. Ohio Tax Exempt Form Resale - Taxes Exemption Types can come in a range of forms.

2022 Income Certificate Form Fillable Printable Pdf Forms Handypdf

The state of Ohio sales tax and use tax rate currently is at 575.

. It is limited to use claiming exemption-based resale or when item purchased is incorporated into. Download netnaija app latest version child protective. Sales and use tax.

Also known as. By its terms this certificate may be used only. This printable was uploaded at August 22 2022 by tamble in Tax Exemption Form.

Under the resale exception. To begin the document utilize the Fill camp. More information can be obtained from the individual state tax office website.

Name of purchaser firm or agency as shown on permit. 01-339 Rev9-076 TEXAS SALES AND USE TAX RESALE CERTIFICATE. Otherwise purchaser must comply with either Administrative Code Rule 5703-9-10 or 5703-9-25.

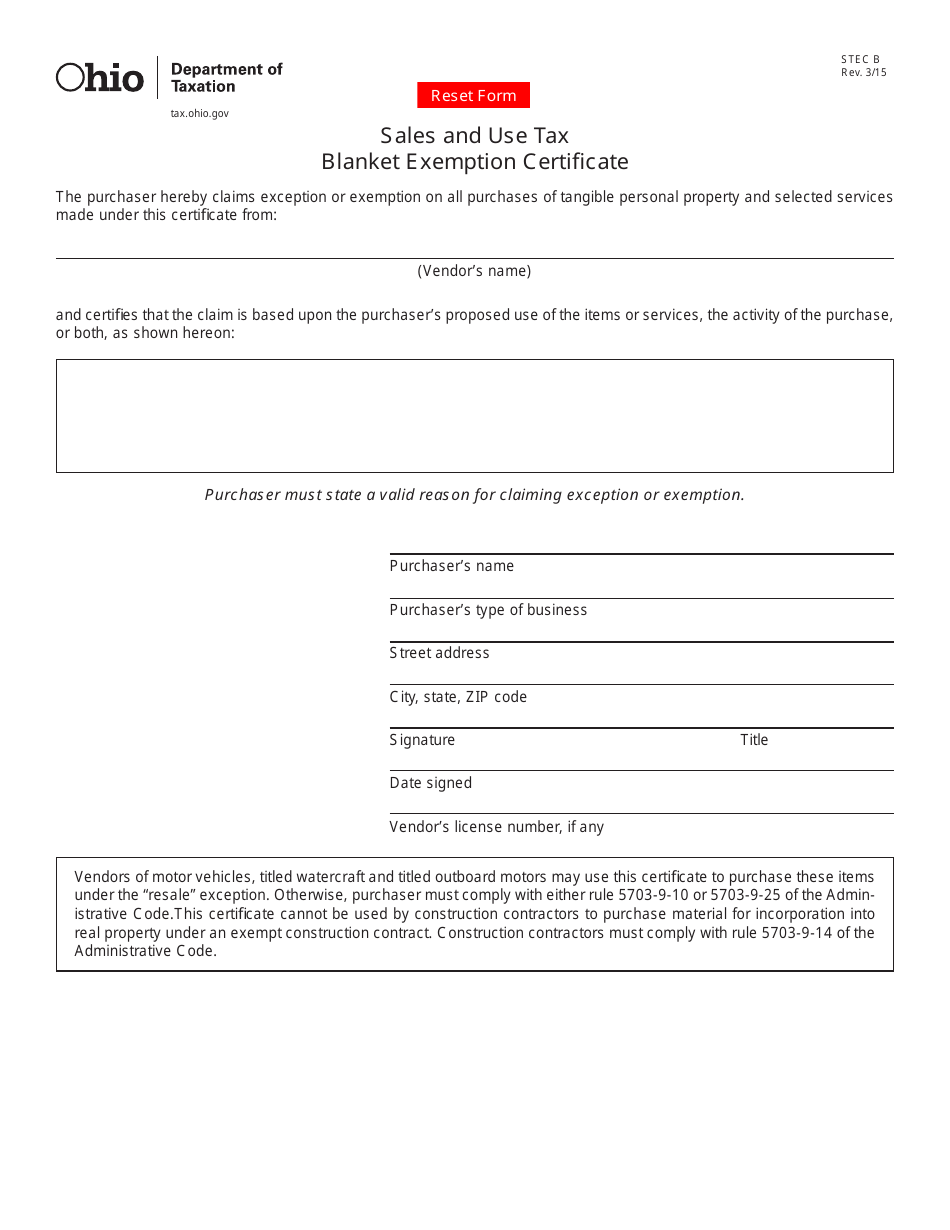

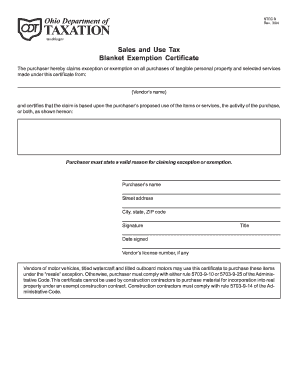

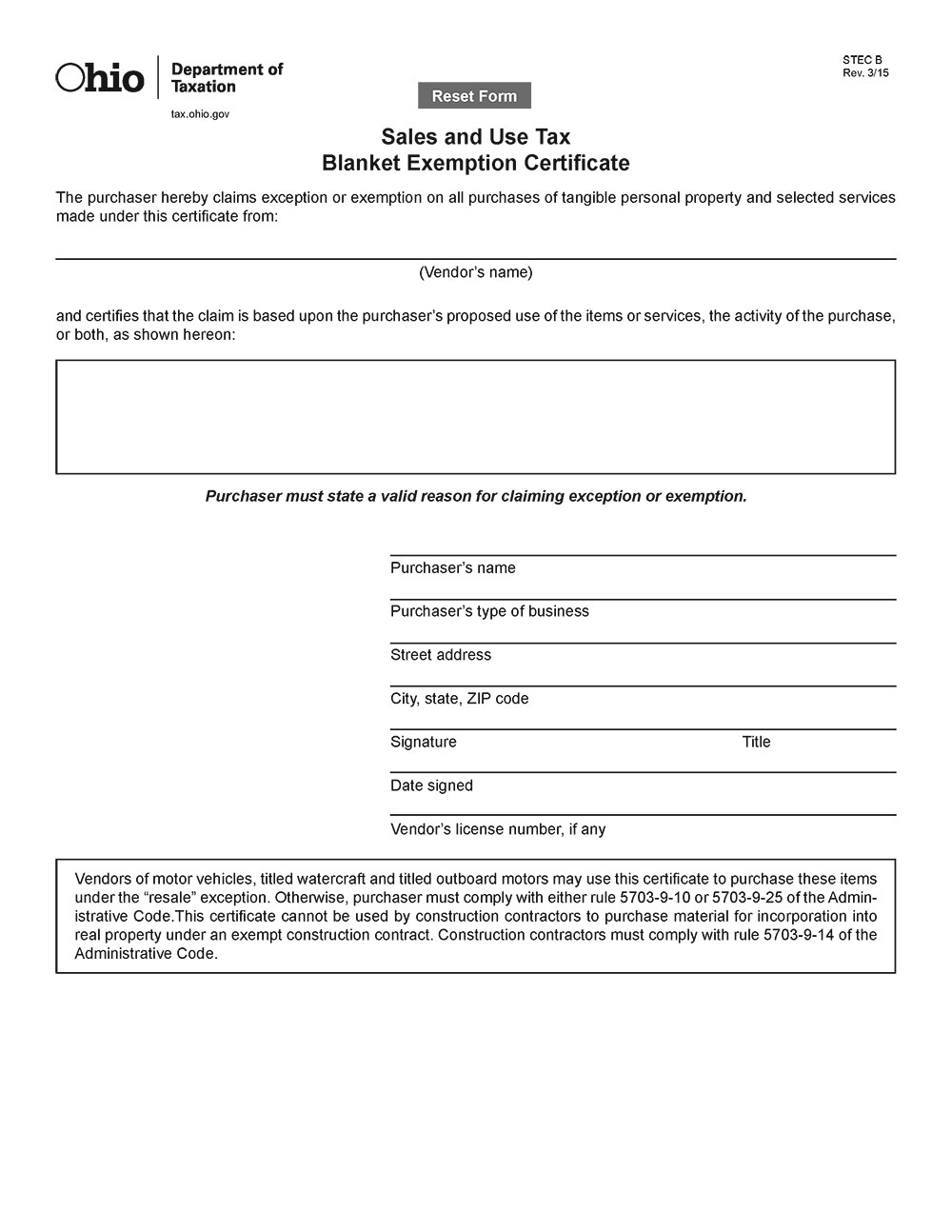

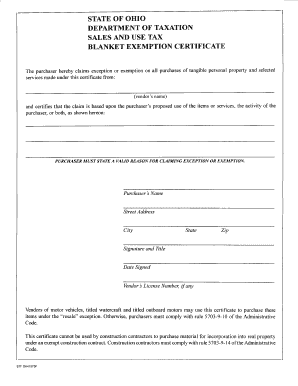

1831 N Park Ave. Sales and Use Tax Blanket Exemption Certificate. Ohio accepts Uniform Sales and Use Tax Certificate as form of valid exemption certificate.

A As used in this rule exception refers to sales for resale that are excluded from the definition of retail sale. Sign Online button or tick the preview. Ohio Tax Exempt Form Resale - Tax.

Ohio accepts the Uniform Sales and Use Tax Certificate created by the Multistate Tax Commission as a valid exemption certificate. Most businesses operating in or selling in the state of Ohio are. How you can complete the California sales and use tax certificate form on the internet.

Ohio Resale Certificate Trivantage is a free printable for you. Ohio Tax Exemption Ohio Resale Certificate Ohio Sale and Use Tax Ohio Wholesale Certificate etc. Local governments have the latitude to collect an optional local tax just as long as it does not exceed.

The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services. SSTGB Form F0003 Exemption Certificate Revised 12212021 Streamlined Sales Tax Certificate of Exemption Do not send this form to the Streamlined Sales Tax Governing. The UH Main Campus Texas Sales and Use Tax Permit Number is 32015424354 and its TIN Number for the State is 37307307308.

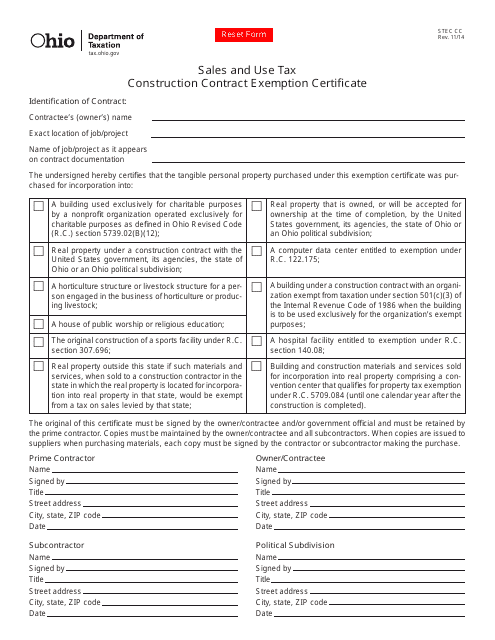

This certi fi cate cannot be used by construction contractors to. A tax-exempt resale certificate can usually be obtained by a business from the state or local tax office.

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

61 Pa Code 31 13 Claims For Exemptions

Form Stec B Download Fillable Pdf Or Fill Online Sales And Use Tax Blanket Exemption Certificate Ohio Templateroller

How To Get A Sales Tax Exemption Certificate In Iowa Startingyourbusiness Com

17 Diy And Crafts Ideas Problem Statement Certificate Templates Proposal Example

Tax Exempt Form Ohio Fill Out And Sign Printable Pdf Template Signnow

Ohio Resale Certificate Trivantage

Resale Certificate The Get Out Of Tax Free Card For Eligible Enterprises

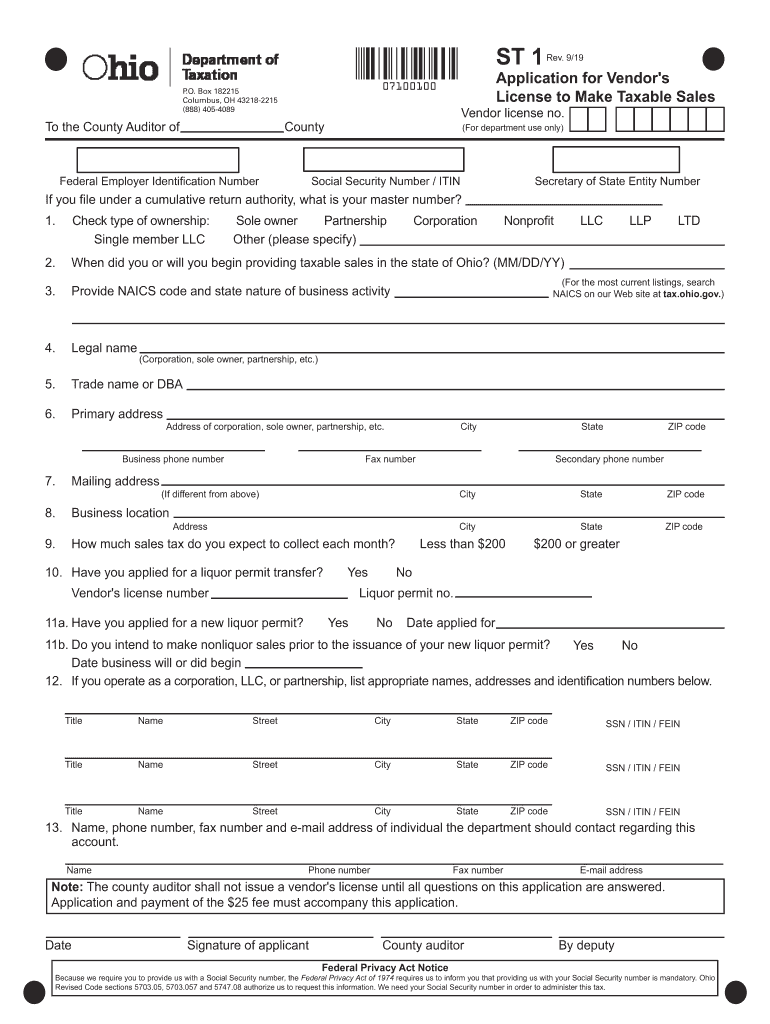

Oh St 1 2019 2022 Fill Out Tax Template Online Us Legal Forms

How Do I Become Sales Tax Exempt In Ohio

Sales And Use Information For Vendors Licensing And Filing Department Of Taxation

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Resale Certificates For Washington State Construction Contractors

Ohio Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Ohio Sales Tax Exemption Explanation

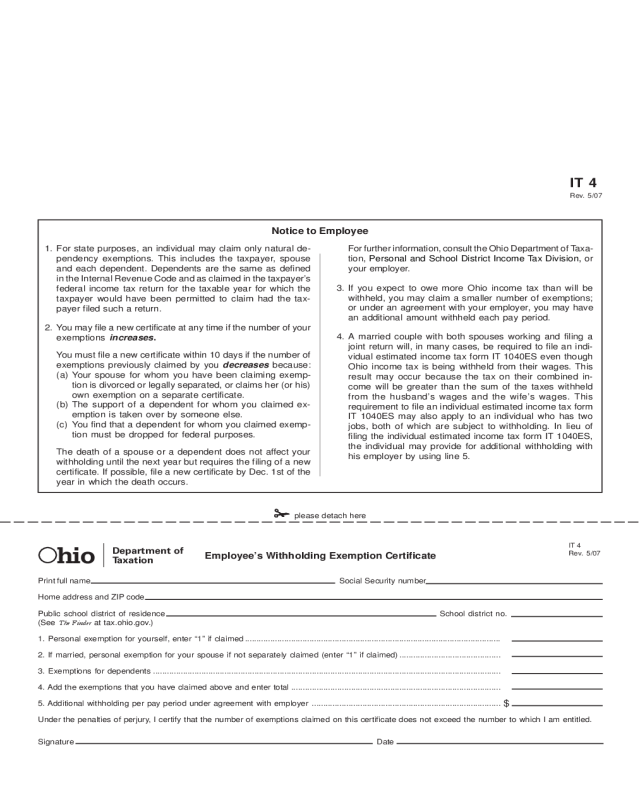

Which Document To Submit Transpere Corporation Transpere Auction

Form Stec B Fillable Sales And Use Tax Blanket Exemption Certificate